Build Now Before Interest Rates Go Up!

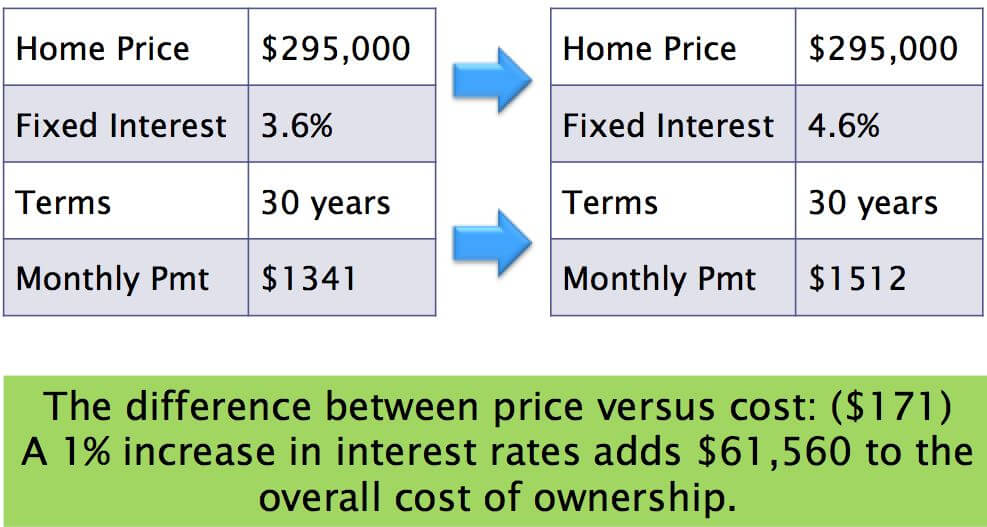

Suppose a home is priced at $295,000. Now, keep in mind the difference between cost and price. The price of $295,000 is a one-time event, while the interest rate represents a 30 year on-going cost.

Please note the difference in payment (cost). A mere one-percent increase in interest rates seems small at only $171 per month. However, an increase in the monthly payment (cost) over 30 years is a whopping $61,560!

When acquiring a home, you must always consider the relationship between cost and price. The price of the home is only $295,000 and is, of course, a one-time consideration and a fixed amount. However, cost is an on-going expense and can dramatically affect the final value of a home. A mere one-percent increase in interest rates represents an additional $171 per month or $61,560 over the entire term of a 30-year loan. When you analyze the situation, it's as if you can say the price of a $295,000 home will now cost $356,560 if interest rates rise by merely another percentage point.